If you are eligible for the Provincial Home Owner Grant, please ensure that the online application is completed a few days prior to the tax deadline to avoid a penalty of 10% on the grant portion. Please note that the Home Owner Grant application must be completed each and every year in which you are eligible for the grant.

A penalty will be applied on the amount of the Home Owner Grant for any unclaimed, unsigned or incomplete applications, as this will be considered equivalent to unpaid taxes. To avoid the penalty on the Grant portion of your taxes, the Home Owner Grant must be claimed even if a payment on outstanding taxes is not made.

The due date for all classes is Tuesday, July 2, 2025. A penalty of 10 percent is applied to outstanding current year taxes at the close of business on July 2, 2025. No Exceptions.

Customers who believe they did not receive their invoice by mail or email will have their address verified by a staff member. For Village purposes, once an invoice has been sent to its billing address it is considered to be received by the recipient.

Please note that the Village Office is located at 423 Davies Avenue and payments are accepted by debit card, cash, cheque, credit card or through online banking if you are a member of Kootenay Savings Credit Union or other credit union.

Credit cards are now accepted by the Village. All credit card transactions are subject a 3% handling fee.

You can set the Village up as ‘payee’ using online banking if you bank with a credit union. For taxes you will need your roll number and, depending on your bank, you may have to add zeros at the beginning of the number sequence to meet the number of numbers required by the bank. For example – your roll # is 123456, bank requires 8 numbers, add two (2) zeros at the start so your number becomes: 00123456 If you have issues setting up a ‘payee’ please contact your bank directly for assistance.

If paying by e-Transfer, please use the email address info@salmo.ca and use villageofsalmo as the password. Failure to use the provided password may result in your payment not being processed on time.

***When paying through online banking, please be aware that it can take 3 to 10 business days for your payment to be received at the Village Office. Please ensure you have initiated the payment with enough time for it to be received by the Village Office by the due date and time. Payment must be received at the Village Office by 4:30 p.m. on the due date of July 2, 2025 for all classes. ***

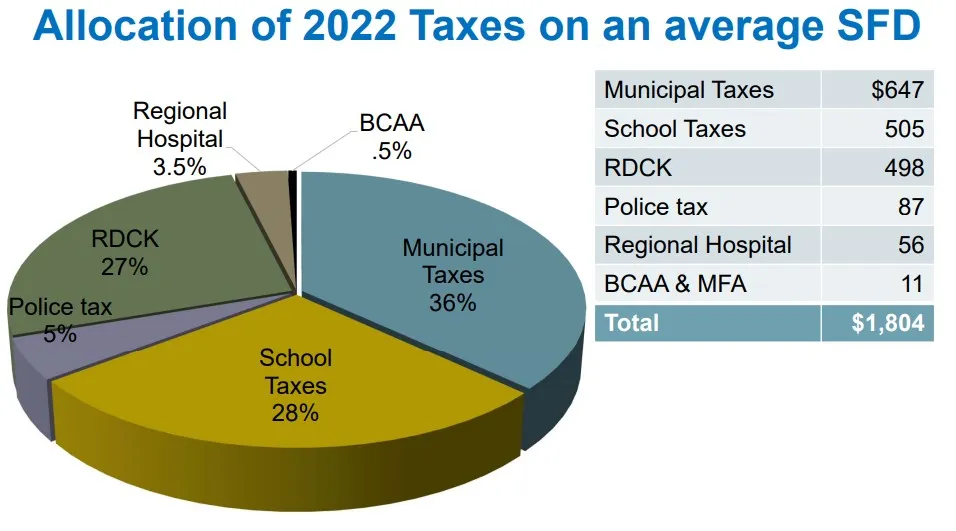

The Village is required to include on property tax statements amounts levied by other taxing authorities over whom the Village has no control. The Village’s percentage of your total tax payable was only 36% in 2016. School taxes collected on behalf of the Provincial government by the Village account for 27% of the tax bill. The remainder of the charges were levied by Regional District of Central Kootenay, Police Levy, Central Kootenay Regional Hospital District, West Kootenay Boundary Regional Hospital, the B.C. Assessment Authority (BC Assessment) and the Municipal Finance Authority (MFA-BC).

For information and inquiries regarding amounts levied by other taxing authorities, please contact them directly at:

Contact

Ph: (250) 357-9433

Fax: (250) 357-9633

Email: info@salmo.ca

Hours

Monday to Friday:

8:30 am – 4:30 pm

Closed: 12:00 pm – 1:00 pm daily